Past Telogical Talks

On June 28th, AT&T officially launched its $15/month WatchTV streaming video product featuring networks from the recently-completed acquisition of Time Warner.

The standalone OTT video service offers 31 linear channels with 6 more channels “coming soon.” The now-standard 7 day free trial applies, and the “usual suspects” of streaming devices are supported, with the notable exception of Roku. (Roku support expected to follow soon.) A WatchTV login supports only 1 simultaneous stream.

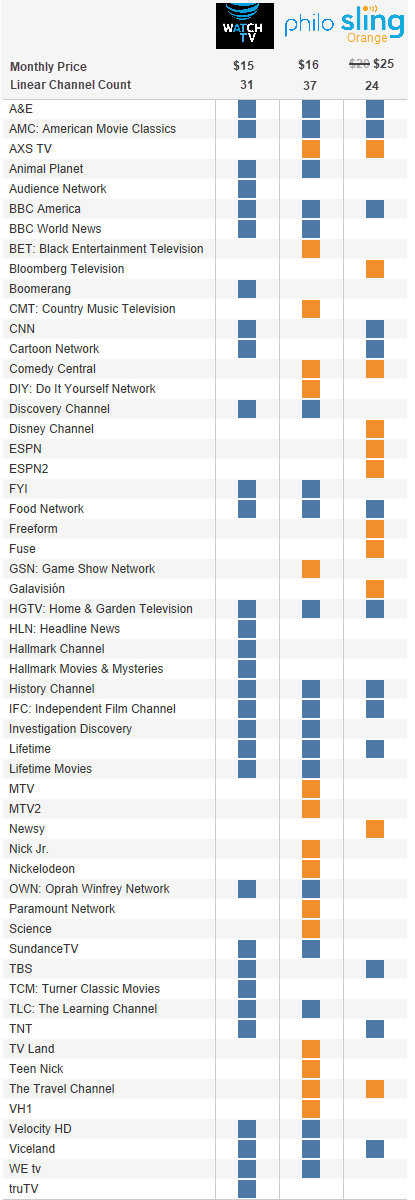

A side-by-side channel comparison of WatchTV against its nearest "skinny bundle" vMVPD competition—Sling TV Orange and Philo—reveals the shared elements of those lineups (no broadcast channels) and notable differences (e.g. Sling TV has some sports programming while Philo includes content from Viacom). The channel lineup, however, is not what makes WatchTV unique in a competitive marketplace of traditional and streaming video providers.

First Rung of the Bundle Ladder

On the same day WatchTV launched, AT&T also unveiled two new Unlimited &More wireless plans. Unlimited &More plans include WatchTV at no extra charge. (Sidebar: The plan name is not a typo. The longer you stare at it, “&More” will start to look like “S’more,” the campfire treat.) AT&T marketing leans into the bundling of live TV with wireless to differentiate its product from the competition, stating plainly on its website: “Verizon and T-Mobile don’t give you that.”

Unlimited &More subscribers also receive a $15/month credit on DIRECTV NOW plans. Unlimited &More Premium customers can use that credit toward DIRECTV NOW, DIRECTV satellite or U-verse plans, and also choose a premium service such as HBO at no additional cost. Similar promotions existed for unlimited wireless customers previously, but now, with its $15 WatchTV package included, customers are given a “risk-free” first step on AT&T’s ladder of video services.

The strategy is clear: AT&T wants to give every Unlimited &More customer an opportunity to sample its video services and subsequently move them up the ladder. Tying perks like bill credits and free premium channels to the bundle deepen the relationship. AT&T has also made some noise about advanced advertising opportunities, but those benefits remain to be seen.

Impact on Video Value Proposition

On the same day AT&T put its marker down on $15, Sling TV CEO, Warren Schlichting, chalked up a $5 price hike for its Orange service-- a 25% rate increase-- to rising programming fees. Analysts generally agree that programming costs make aggressively-priced vMVPD services “profit-challenged,” to put it charitably, but AT&T’s vertical bundle and deep-pockets allow it to find profits elsewhere in the customer relationship.

With AT&T aggressively entering the low-end of the market, pressure is mounting on traditional video providers. Expect heavy-artillery marketing from AT&T touting the benefits of WatchTV.

By making the first rung in the video ladder so low, non-AT&T video customers may perceive less value from their existing video service providers, posing a new retention challenge. Especially at risk to disconnect, AT&T wireless customers who will eventually recognize they are paying twice for many of the same channels unless they bundle their video service with AT&T.

The WatchTV launch bets heavily on a bundle anchored by wireless service. Long live the bundle.

Channel Lineup Comparison

At Telogical, we’re always studying the competitive landscape. If you have a topic you’d like to discuss with us, please reach out. We look forward to working with you.