In the 1983 movie, Wargames, Matthew Broderick’s character, David, hacked his way into NORAD’s missile-defense “WOPR” system by connecting to it via a 1200 baud dial-up modem. (That’s 1.2 kbps or 0.001 Mbps.)

The movie still holds up today thanks to its resonant lesson. [36 year-old spoiler alert: Cold War annihilation averted. “The only winning move is not to play.”]

But times have certainly changed in the world of connectivity since that 1200 baud modem appeared on screen. In just the last few years, fiber build-outs and widespread deployment of DOCSIS 3.1 technology have dramatically raised the bandwidth bar, and more households than ever have access to speeds ranging from 100 Mbps to a Gigabit.

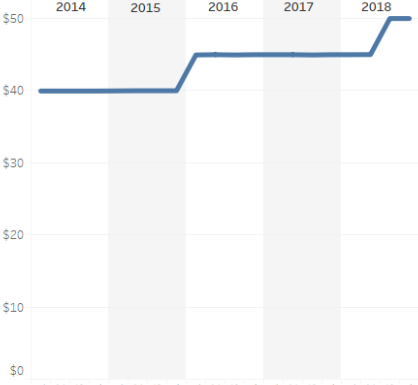

As advertised speeds have risen, so have internet service prices. Pricing data collected by Telogical from 30 representative U.S. markets over the past five years reflect a slow, but steady ratcheting-up of the median advertised price of broadband service. In 2018, the median advertised price rose to $50.

Internet Only Median Advertised Price, Past 5 Years

Faster, Faster

The most recent increase in median internet price reflects changing dynamics in the marketplace for speed. While telco fiber deployments and overbuilds did not expanded significantly in 2018, cable companies focused heavily on the higher speeds made possible by the deployment of D3.1. Notably, Charter just announced it had completed its D3.1 rollout and would be lowering capital expenditures by $2 billion in 2019.

The widening availability of faster speeds played out in the pricing data Telogical collected. At the beginning of 2018, less than 20% of the advertised prices came from 101 Mbps or greater speed services. By the end of the year, over 30% of the offers gathered came from the high-end of the speed menu. (See chart below.) This push to position higher-end service drove the overall broadband median price up in 2018.

Another somewhat suprising factor drove the overall median price of broadband up in 2018: advertised median prices for lower speed service (50 Mbps and under) rose from $40 to $45 as providers reduced promotions on lower-speed tiers. The basic necessity of having a connection creates a floor under internet pricing.

Internet Only Median Advertised Price by Speed Tier Range

Revenue Pressure

Before 5G deploys to become a legitimate, wireless alternative to traditional broadband service, the "wired" part of the telecom industry has a few options to continue to grow revenue from its bread-and-butter internet product:

Slowly increase internet ARPU to alleviate video revenue erosion – Check! Expect this pattern to continue. Every finance department is following the same playbook.

Create and/or enforce usage caps, effectively charging customers extra for media-rich usage patterns that include increasing OTT video – Unlikely, given the wireless industry retreat to offer Unlimited plans.

Aim distribution fees at video streaming services under relaxed “net neutrality” rules – Very Possible. Whether through the carrot of a partnership or the stick of a gatekeeper fee, ISPs hold the critical advantage of being the (non-exclusive) delivery vehicle for all of these new video services.

As bundled video revenues continue to shrink, expect broadband providers to find ways to claw back some of that lost revenue from OTT services. The number one tool at the industry's disposal, however, is pricing, and if long-term trends hold, those show no sign of going down.

At Telogical, we’re always studying the competitive landscape. If you have a topic you’d like to discuss with us, please reach out. We look forward to working with you.